Introduction

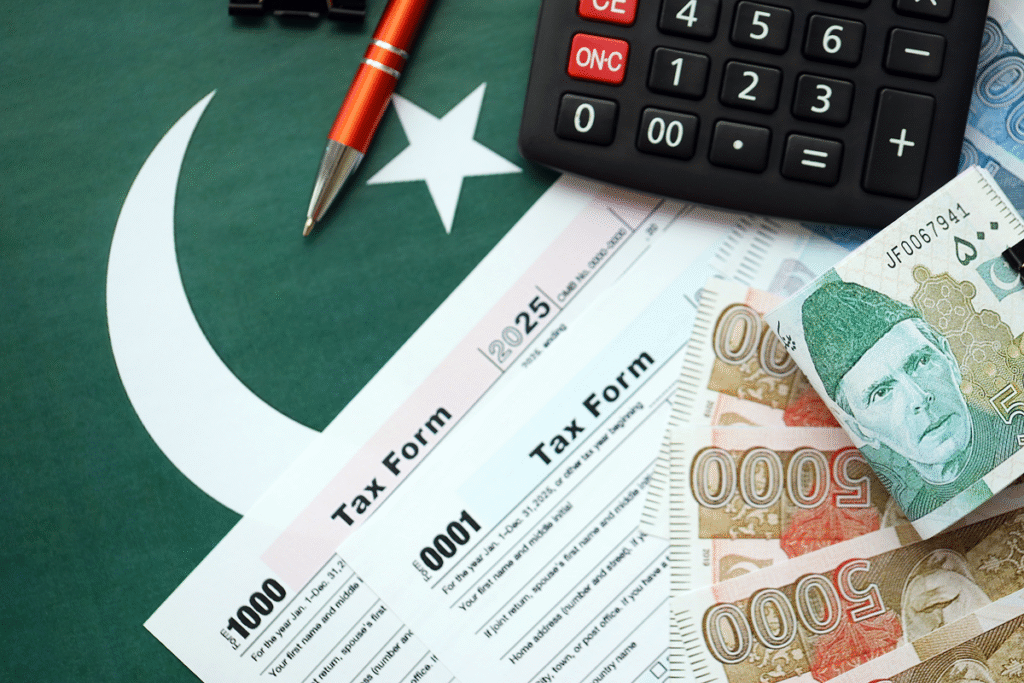

Filing taxes is one of the most important responsibilities for individuals and businesses in Pakistan. The government requires all income-earning individuals and entities to comply with tax regulations, and filing an income tax return ensures transparency and legal compliance. Knowing how to file income tax returns in Pakistan is essential for anyone earning taxable income, whether salaried, self-employed, or running a business.

Filing an income tax return not only fulfills legal obligations but also provides several benefits, such as maintaining filer status, avoiding penalties, and accessing certain government services. In addition to income tax, many businesses must also file FBR sales tax return Pakistan if they are registered under the sales tax law. Understanding both processes helps taxpayers stay compliant and avoid legal complications.

This guide explains step-by-step how to file an income tax return in Pakistan, who must file, the relationship with sales tax, common mistakes, deadlines, and tips for smooth compliance.

Who Must File Returns

Understanding who is required to file an income tax return is the first step in tax compliance. Any individual or entity earning taxable income in Pakistan must file income tax return Pakistan. This includes salaried employees whose income exceeds the tax threshold, self-employed professionals, freelancers, and business owners.

Companies registered with SECP, partnership firms, and sole proprietorships are also required to file income tax returns. Filing ensures that all income is officially documented, taxes are paid appropriately, and the filer maintains a valid status in FBR records.

Businesses that are registered for sales tax must also submit FBR sales tax return Pakistan. Even if a business does not have taxable profits, failing to file required sales tax returns can result in penalties or suspension of business activities. Understanding the link between income tax and sales tax helps businesses maintain complete compliance.

Income Tax Return Filing Steps

Filing an income tax return in Pakistan has become easier thanks to the FBR IRIS online system. The process allows individuals and businesses to file income tax return Pakistan without visiting tax offices physically. Here is a step-by-step guide:

- Create an FBR Account:

Visit the FBR IRIS portal and create an account using a valid CNIC or NTN. This account is necessary for filing both income tax and sales tax returns. - Collect Necessary Documents:

For salaried individuals, documents include salary slips, tax deduction certificates, and bank statements. Business owners and freelancers need income statements, expense receipts, and invoices. - Login to the IRIS Portal:

After account creation, log in and select the option to file income tax return Pakistan. - Select the Correct Tax Year:

Ensure you select the correct tax year for which the return is being filed. Using the wrong year may result in errors or penalties. - Enter Income Details:

Provide complete and accurate information about all income sources. This includes salary, business income, freelance earnings, investments, and other taxable sources. - Claim Allowable Deductions:

Enter any allowable deductions, including business expenses, charitable donations, and other tax credits. Accurate deductions reduce the overall tax liability. - Verify and Submit:

Review all entered information carefully to avoid mistakes. Submit the return online and save a copy of the acknowledgment for records.

Completing these steps ensures proper file income tax return Pakistan compliance and helps avoid legal issues.

Sales Tax Return Overview

Many businesses that are registered for sales tax must also file FBR sales tax return Pakistan on a monthly basis. Sales tax focuses on transactions, while income tax focuses on earnings. Even if a business files income tax returns regularly, sales tax return filing is a separate legal requirement.

The FBR sales tax return Pakistan process requires reporting total sales, sales tax collected, and input tax claimed. These returns are submitted through the FBR IRIS portal, and failure to file can result in penalties, default status, or even suspension of business operations.

It is important for businesses to maintain proper accounting and invoices to ensure accurate FBR sales tax return Pakistan filings. Cross-checking income and sales data helps avoid discrepancies between income tax returns and sales tax records, which could trigger audits.

Deadlines

Timely filing is crucial for compliance. Individuals and businesses must adhere to the deadlines set by FBR to avoid penalties. Salaried individuals and business owners must file income tax return Pakistan by September 30 of the following tax year, though deadlines may vary for special cases.

FBR sales tax return Pakistan is typically filed monthly, with submissions due by the 15th day of the following month. Missing deadlines for sales tax can result in fines, while late income tax returns may attract additional penalties and interest charges.

Maintaining a calendar of due dates and preparing documents in advance ensures timely filing and reduces stress during tax season.

Common Mistakes to Avoid

Many taxpayers make mistakes when they file income tax return Pakistan, which can lead to penalties or delays. Common errors include:

- Entering incorrect CNIC or NTN information

- Forgetting to include all income sources

- Reporting inaccurate deductions

- Missing deadlines for either income tax or FBR sales tax return Pakistan

- Filing under the wrong tax year

- Failing to cross-check income and sales records

Avoiding these mistakes requires careful attention, proper record-keeping, and understanding of FBR guidelines. Businesses may also consider hiring professional accountants to ensure accuracy.

Benefits of Filing on Time

Filing an income tax return on time offers several benefits. Individuals maintain their filer status, which reduces withholding tax rates on banking transactions, property purchases, and other financial activities. Businesses that timely file income tax return Pakistan and submit FBR sales tax return Pakistan enjoy credibility, smoother operations, and access to government incentives.

Accurate filing also minimizes the risk of audits, penalties, and legal notices. Maintaining compliance builds trust with customers, suppliers, and financial institutions.

Tips for Smooth Filing

- To make filing easier, consider these tips:

- Keep all income and sales records organized throughout the year

- Maintain a copy of invoices, salary slips, bank statements, and receipts

- Review FBR guidelines before filing

- Cross-check sales and income data to ensure consistency

- Use the FBR IRIS portal carefully and save acknowledgment slips after submission

Following these steps ensures that taxpayers can file income tax return Pakistan and FBR sales tax return Pakistan without issues.

Conclusion

Filing taxes is a legal and essential responsibility for all income earners and businesses in Pakistan. Understanding how to file income tax return Pakistan and the relationship with FBR sales tax return Pakistan ensures complete compliance, reduces the risk of penalties, and strengthens business credibility.

By following the correct steps, maintaining accurate records, and filing on time, individuals and businesses can operate confidently within Pakistan’s tax framework. Proper compliance not only fulfills legal obligations but also contributes to a transparent, documented economy, benefiting both the taxpayer and the country.

Taxpayers are encouraged to take filing seriously, use professional support if necessary, and always keep records organized to make the process smooth and efficient.