What Is Sole Proprietorship

A sole proprietorship is the simplest and most common form of business ownership in Pakistan. In sole proprietorship registration Pakistan, a single individual owns, manages, and controls the entire business. There is no legal separation between the business and the owner, which means all profits belong to the owner, and all responsibilities are also carried personally.

Many small traders, freelancers, shop owners, consultants, and service providers choose this structure because it is easy to start and requires minimal legal formalities. Sole proprietorship registration Pakistan does not involve complex company laws or lengthy approval processes. Instead, the focus is mainly on NTN registration with FBR Pakistan, which gives the business legal recognition for tax purposes.

Unlike companies registered with SECP, a sole proprietorship does not have a separate legal identity. However, for individuals starting on a small scale or testing a business idea, this structure offers flexibility and speed.

Who Should Choose Sole Proprietorship

Sole proprietorship registration Pakistan is ideal for individuals who want full control over their business and prefer a simple operational structure. People who run home-based businesses, online stores, small retail shops, or professional services often find this model suitable.

Freelancers, digital marketers, content creators, IT consultants, and trainers usually prefer sole proprietorship because it allows them to operate independently without partners or shareholders. For such individuals, NTN registration with FBR Pakistan is usually enough to legally operate, issue invoices, and open a business bank account.

This structure is also suitable for businesses with low startup capital and minimal risk. If the business does not require external investment or complex legal contracts, sole proprietorship registration Pakistan can be a practical choice.

However, individuals planning rapid expansion, hiring large teams, or working with corporate clients may later consider switching to a company structure. Still, for beginners, sole proprietorship offers an easy and cost-effective starting point.

NTN Registration With FBR Pakistan

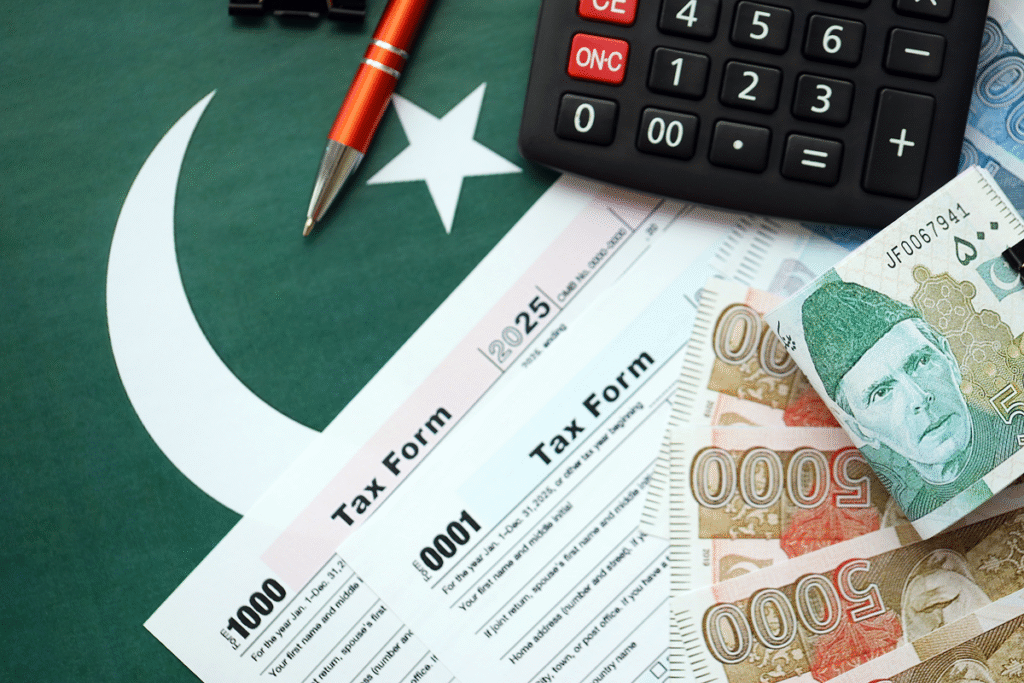

The most important step in sole proprietorship registration in Pakistan is NTN registration with FBR Pakistan. The National Tax Number (NTN) is issued by the Federal Board of Revenue and serves as the official tax identity of the business owner.

NTN registration with FBR Pakistan can be completed online through the FBR Iris portal. The applicant needs to create an account, fill in personal and business details, and submit the required information. Once approved, the NTN is issued, allowing the individual to file taxes and conduct business legally.

For sole proprietors, the NTN is issued in the individual’s name, not the business name. However, the business name can still be used for branding, bank accounts, and invoices. NTN registration with FBR Pakistan also allows businesses to register for sales tax if required.

Without NTN registration, a sole proprietorship may face difficulties opening bank accounts, receiving payments from corporate clients, or complying with tax laws. Therefore, NTN registration with FBR Pakistan is a critical part of sole proprietorship registration Pakistan.

Required Documents

The documentation required for sole proprietorship registration Pakistan is relatively simple compared to company registration. Most of the documentation is related to NTN registration with FBR Pakistan.

The basic documents include a valid CNIC of the business owner, proof of business address, and contact details. For NTN registration with FBR Pakistan, information about the nature of business, source of income, and bank account details may also be required.

If the business operates under a trade name, some banks may ask for a letterhead or business stamp. While not legally mandatory, these elements help in professional dealings.

Having accurate and up-to-date documents ensures smooth sole proprietorship registration in Pakistan and avoids delays during NTN registration with FBR Pakistan.

Advantages and Disadvantages

One of the biggest advantages of sole proprietorship registration in Pakistan is simplicity. The business can be started quickly, with minimal costs and paperwork. Decision-making is fast because there are no partners or shareholders involved.

Another advantage is full control over profits. The owner keeps all earnings and can make business decisions independently. Compliance requirements are also limited, making it easier to manage operations.

However, there are disadvantages as well. Unlimited liability is a major concern, as the owner is personally responsible for all debts and losses. This means personal assets can be at risk if the business faces financial trouble.

In addition, raising capital can be challenging. Investors and banks often prefer registered companies over sole proprietorships. While NTN registration with FBR Pakistan provides legal recognition, it does not offer the same credibility as SECP registration.

Understanding these advantages and disadvantages helps individuals decide whether sole proprietorship registration Pakistan aligns with their business goals.

Compliance Tips

After completing sole proprietorship registration Pakistan, ongoing compliance is essential to avoid legal and financial issues. Regular tax filing is the most important responsibility. Once NTN registration with FBR Pakistan is complete, the business owner must file annual income tax returns.

Maintaining proper financial records, including income and expenses, helps in accurate tax reporting. Even small businesses benefit from basic bookkeeping practices.

If the business crosses the sales tax threshold, sales tax registration and filing may also become mandatory. Staying updated with FBR regulations ensures smooth operations and avoids penalties.

Compliance may seem simple, but consistency is key. Regular filings and documentation protect the business and build trust with clients and authorities.

Conclusion

Sole proprietorship registration Pakistan is an ideal option for individuals who want to start a business quickly with minimal investment and legal complexity. It offers flexibility, independence, and ease of management, making it suitable for freelancers, small traders, and service providers.

However, NTN registration with FBR Pakistan is a crucial step that gives the business legal identity and ensures compliance with tax laws. Without proper registration, businesses may face operational and financial difficulties.

By understanding the registration process, documentation requirements, advantages, and compliance responsibilities, individuals can confidently start and manage their sole proprietorship in Pakistan. As the business grows, the structure can always be upgraded, but a strong and compliant start sets the foundation for long-term success.